Free Living Trust Forms Illinois

Unlike a will a trust does not go through the probate process with the court.

Free living trust forms illinois. A living trust is a document that allows individual s or grantor to place their assets to the benefit of someone else at their death or incapacitation. Living trusts are well known estate planning devices for families. Unlike a will this document is created during the course of the grantor s. A living trust is designed especially for the survivors to avoid probate.

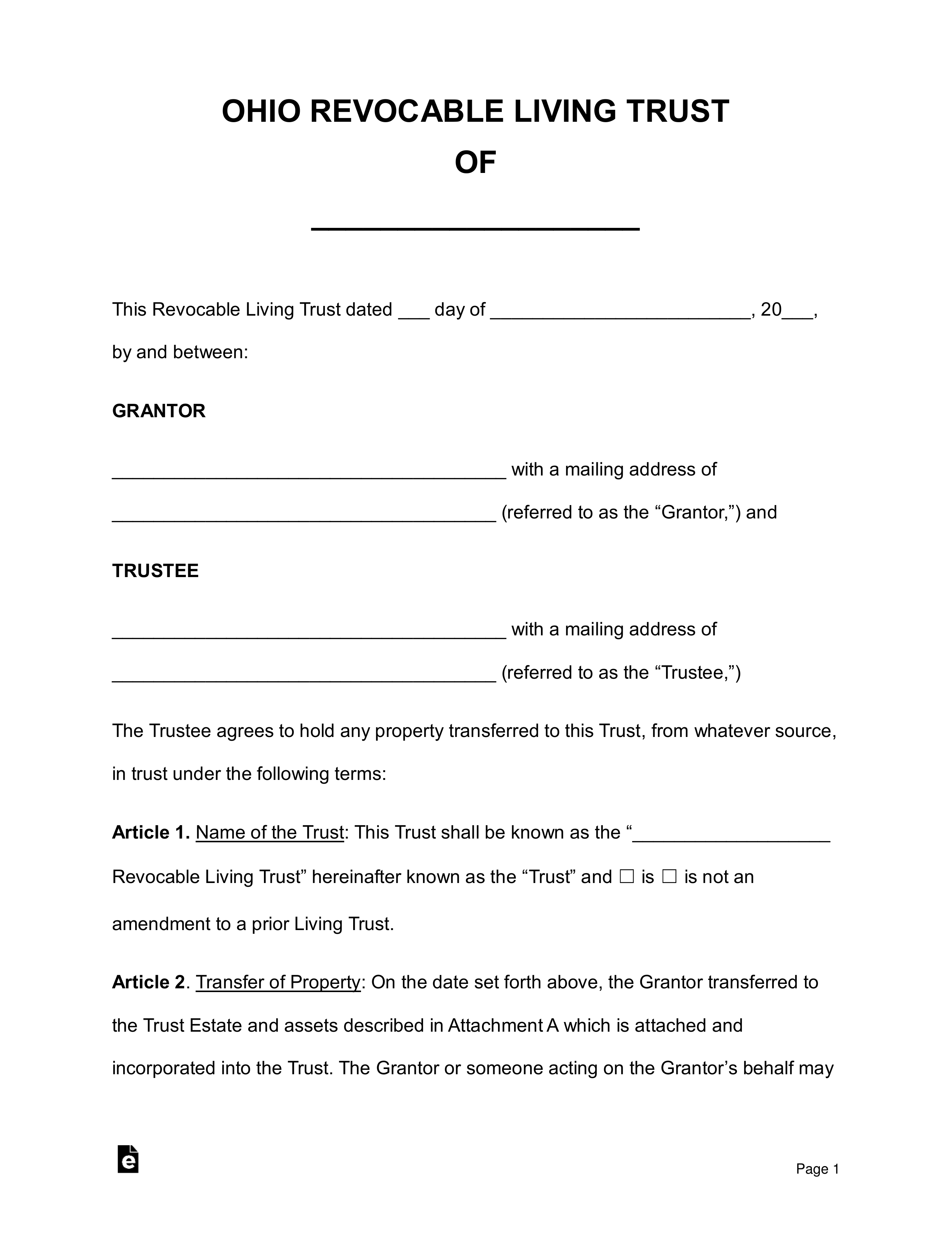

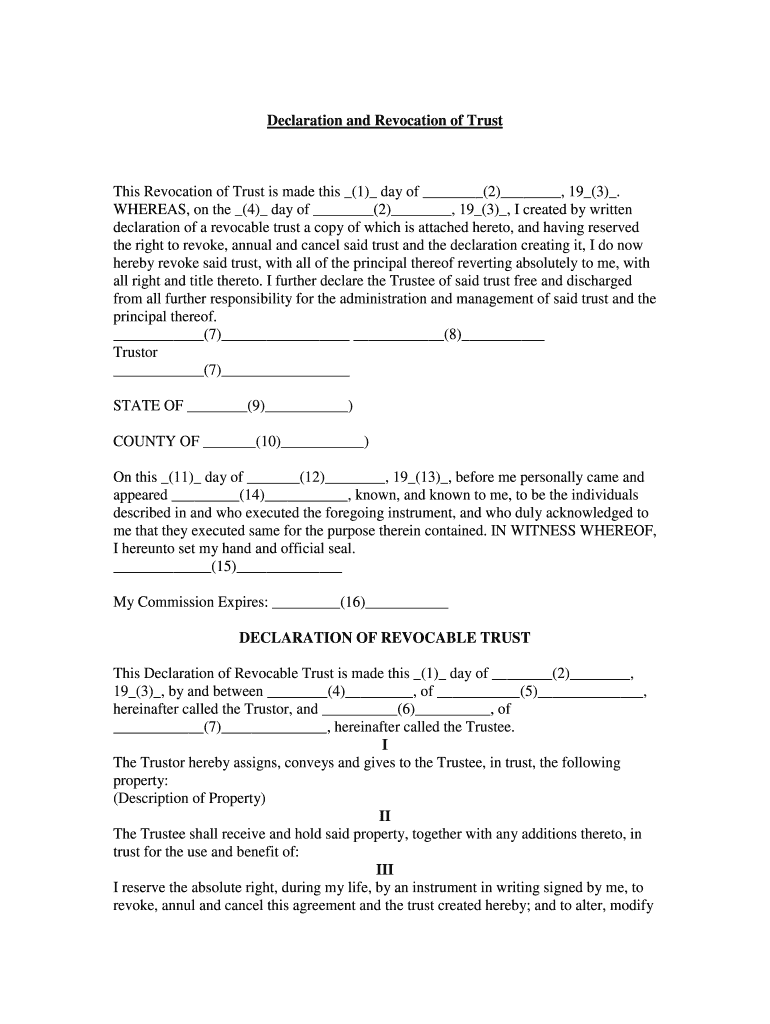

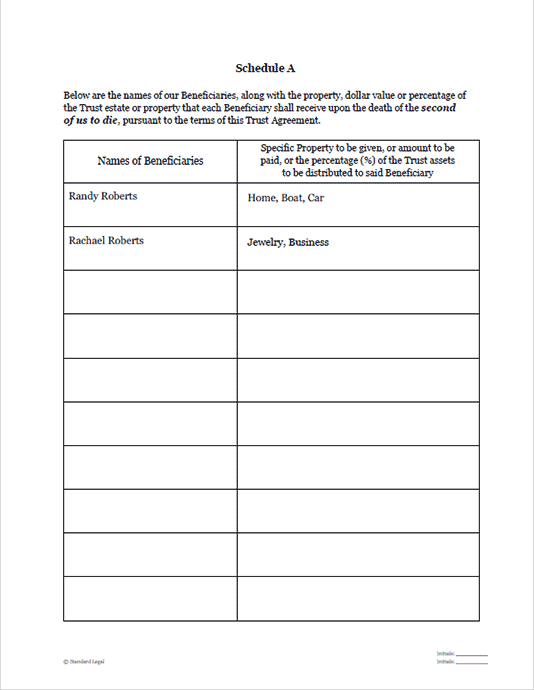

A revocable living trust is created by an individual the grantor for the purpose of holding their assets and property and in order to dictate how said assets and property will be distributed upon the grantor s death. The grantor maintains ownership over their assets and they can make alterations to the document or choose to revoke the trust at any point in their lifetime. A living trust is a legal form devised and drafted to transfer a person s assets to designated beneficiaries when that person dies. The joint living trust form can be employed to institute a trust that can be cancelled or revoked by the grantor or grantors at any time.

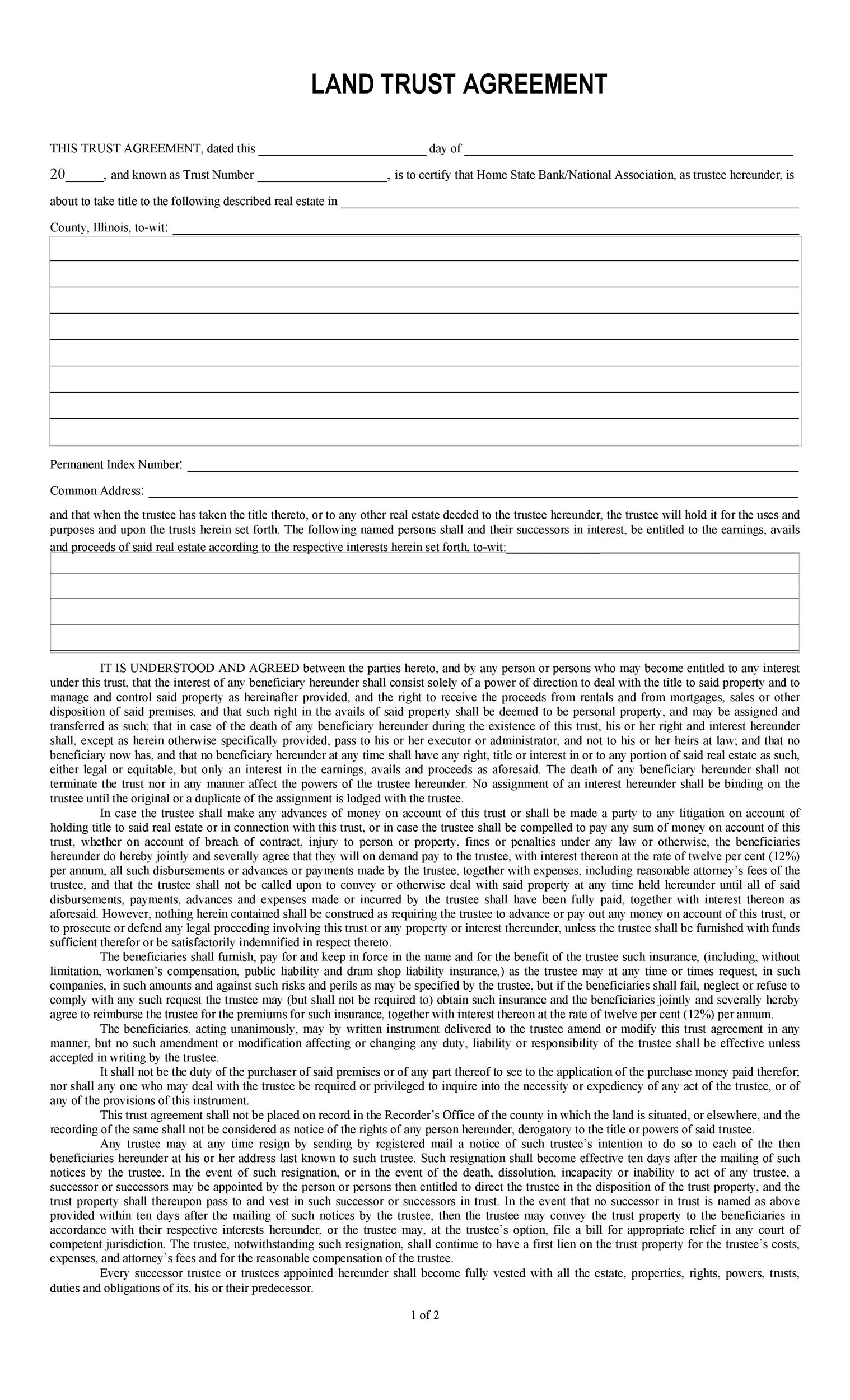

Download free living trust forms online fast. For instance a grantor can decide that he or she doesn t want the beneficiary to receive the assets or property until they have reached a certain age. An illinois living trust form is a legal document that is drafted to transfer a person s assets on to their named beneficiaries upon death. The illinois revocable living trust is an entity into which a person places their assets to save the inheritors the long and costly probate process in illinois.

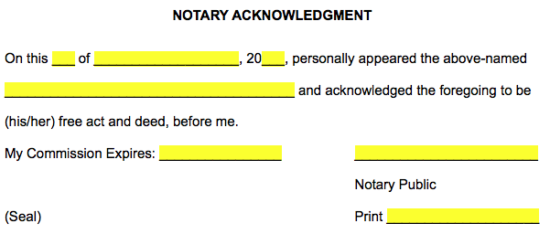

An illinois living trust is a document that allows the recipient s of a deceased individual s assets to avoid the court supervised probate process implemented after a person dies the initial creator of the trust referred to as the grantor will transfer property and assets to the trust and outline specific instructions for what shall be done with said property and assets when they die. Therefore the person that is selected as the successor trustee will oversee that all the property in the trust will transfer to the beneficiary at the time. Download the illinois living trust that allows a person called a grantor to set aside assets and property into a separate entity by which he or she can specify how when and to whom the property and assets are distributed. To add real estate to a living trust the grantor s of the trust create a real property deed with the living trust named as grantee.

Download a living trust also known as a inter vivos trust that allows an individual the grantor to gift assets and or property during the course of their life to another individual the beneficiary the trustee will be in charge of handling the property even though it belongs to the beneficiary. If you are wed and contemplating establishing a trust for estate preparation objectives one of the very first things you will really need to figure out is whether to set up a joint living trust or separate.